Nevada’s Revenue Forecast: Implications for State Budget

Nevada’s budget outlook for the upcoming two years has taken a significant hit, with lawmakers facing a reduction of approximately $191 million, equating to a 1.6 percent decline. This downturn is expected to prompt budget cuts and complicate various legislative initiatives requiring funding.

Revenue Projections Decline

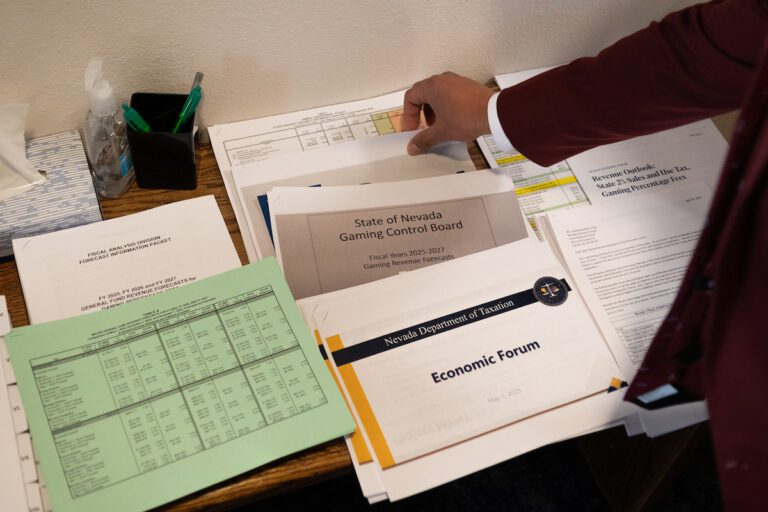

According to a report from The Nevada Independent, the State Education Fund anticipates a nearly $160 million decrease in expected revenue, leading to a total shortfall around $350 million. The Economic Forum, a committee of economists charged with producing tax revenue forecasts, estimates that state revenues will total about $12.2 billion in the next budget cycle—down from a prior projection of $12.4 billion.

Significant Economic Changes

This adjustment marks the first decrease in revenue projections since 2009 and comes just a month before the legislative session ends. Lawmakers are now tasked with ensuring the budget remains balanced amidst these constraints.

Reasons for Revenue Shortfall

The primary contributor to the revenue drop is attributed to declines in sales and use tax income, alongside lower forecasts for the modified business and commerce taxes. These financial declines have been largely contextualized by the economic policies during the Trump administration. While certain revenues, such as insurance premium and property taxes, have shown some increases, they do not fully offset the overall projections.

Impact on Legislative Proposals

The budget shortfall threatens over 300 bills currently stalled in fiscal committees. Many of these initiatives, including significant proposals to expand the film tax credit, may now face significant hurdles. About $130 million in previous funding requests for new programs, already declined by fiscal committees, still leave a considerable gap.

Responses from State Leaders

Governor Joe Lombardo’s office believes the financial shortfall is manageable and that the state is well-equipped to address any budgetary concerns with its emergency fund. “Nevadans can rest assured that the State is well-prepared to navigate moments of fiscal uncertainty,” stated Elizabeth Ray, spokesperson for Gov. Lombardo.

In contrast, Senate Majority Leader Nicole Cannizzaro expressed concern regarding maintaining essential government services, raising the possibility of a special session to address budget cuts. She identified the Trump administration’s policies as a significant factor in the anticipated revenue decline, stating, “The more that people are not willing to come to Nevada…the less we’re able to provide those services.”

Economic Outlook and Future Considerations

Economists are also warning of potential economic strains, including labor shortages and fluctuations in tourism, particularly from Canada. According to Emily Mandel from Moody’s Analytics, changes in vacation planning by Canadians could notably affect Nevada’s tourism economy.

Sector-Specific Revenue Impacts

The Economic Forum highlights the state’s sales and use tax is projected to drop by $102 million. Lower-than-expected job growth has also led to decreased collections from the modified business tax. Other anticipated declines in revenue include reduced earnings from the treasurer’s office and the commerce tax.

Positive Indicators

On a more positive note, the insurance premium tax is expected to see an increase of $46 million, reflecting that insurance costs remain a priority for consumers even in economic downturns. Additionally, projections for the live entertainment and gaming industries are staying steady, with no immediate changes observed.

Conclusion

The updated revenue forecasts present a significant challenge for Nevada’s lawmakers as they navigate budgetary constraints while striving to maintain essential services and explore new legislative opportunities. With an onus to react quickly, the coming weeks will be pivotal for the state’s fiscal future.