The Case for Abolishing the Redevelopment Agency in Reno

By George Eddie Lorton

Introduction

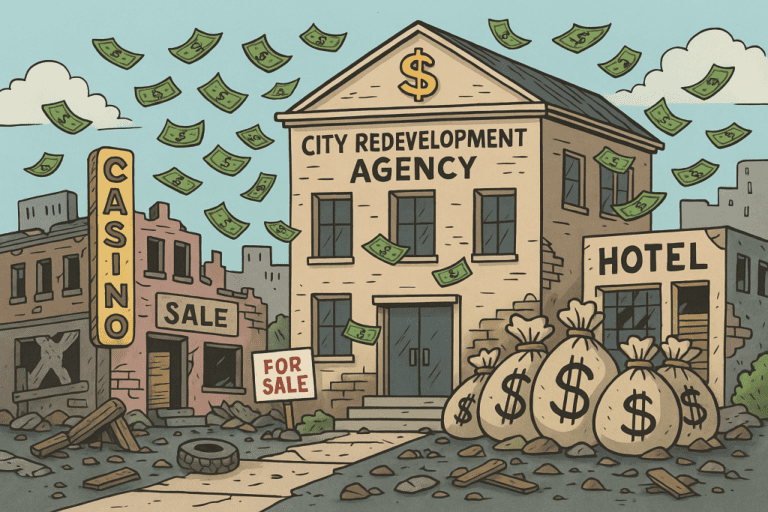

For over a decade, I have been vocal about the detrimental impact of the Redevelopment Agency on Reno’s governance and fiscal health. Once a promising initiative, this agency has devolved into a tool for corruption, used by elected officials to benefit themselves at the expense of taxpayer interests. It is vital to discuss the necessary steps to rectify this situation.

The Core Issues with the Redevelopment Agency

The Redevelopment Agency has operated unchecked, fostering a culture of corruption among officials. A comparable scenario unfolded in California, where the state abolished its redevelopment agencies due to similar corrupt practices involving public funds and private interests, particularly with developers and casinos. Reno’s agency manages substantial real estate assets, many of which bypass public auction processes, leading to dubious transactions that favor selected parties instead of the community at large.

Current properties under city control, such as the National Bowling Stadium and Reno Events Center, do not contribute to property tax revenues, placing further financial burdens on taxpayers while the city attempts to raise property taxes in other areas.

Financial Implications for Reno

Despite the city’s acknowledgment of a $24 million deficit, it holds valuable assets like the Downtown Reno Ballroom, which alone is valued at $65 million. Selling these assets through public auctions could not only alleviate budget deficits but also reintroduce these properties to the tax base, generating new revenue streams. Such a strategy must extend to other city-owned properties to truly address financial inefficiencies.

Examples of Mismanagement

The misapplication of powers granted to the Redevelopment Agency has led to several troubling examples of favoritism and malfeasance:

- The Eldorado/Caesars Entertainment lease for the Downtown Reno Ballroom allows them to enjoy the space without paying rent while taxpayers cover the operational costs and bond debts.

- A lease to the National Bowling Stadium, issued to the ex-business partner of Mayor Hillary Schieve for a haunted house project, exemplifies how personal connections influence public property usage.

- The Jacobs Group benefitted from below-market land deals without undergoing the competitive auction process, bypassing potential revenue opportunities for the city.

The True Extent of Reno’s Debt

The reported $472 million debt of Reno does not accurately reflect the city’s financial situation. Major liabilities, including $260 million related to PERS and over $400 million associated with the train trench, inflate the real debt burden which may range between $800 million and $1 billion. This scenario underscores the need for reevaluation of priorities—should the city finance developers rather than providing essential services to its residents?

Conclusion: A Call to Reassess Governance

The current financial state of Reno presents an opportunity for change. Instead of perpetuating schemes that widen budget gaps under the guise of financial management, the city must consider abolishing the Redevelopment Agency. This move can help eliminate corrupt practices and prioritize the community’s best interests over political gains.